From human velocity to AI velocity: Accelerated engineering in financial services

The first wave of enterprise AI was tactical: chatbots, fraud detection, workflow automation. Useful, yes. Transformational, no.

What’s emerging now is something deeper: a structural opportunity to reimagine how software is built. Not by adding AI to existing processes, but by architecting for AI-native velocity from the ground up. This isn’t about shortcuts. It’s about compound impact.

And in financial services—where seconds matter and trust is non-negotiable—that shift is especially urgent.

Accelerated engineering is that shift

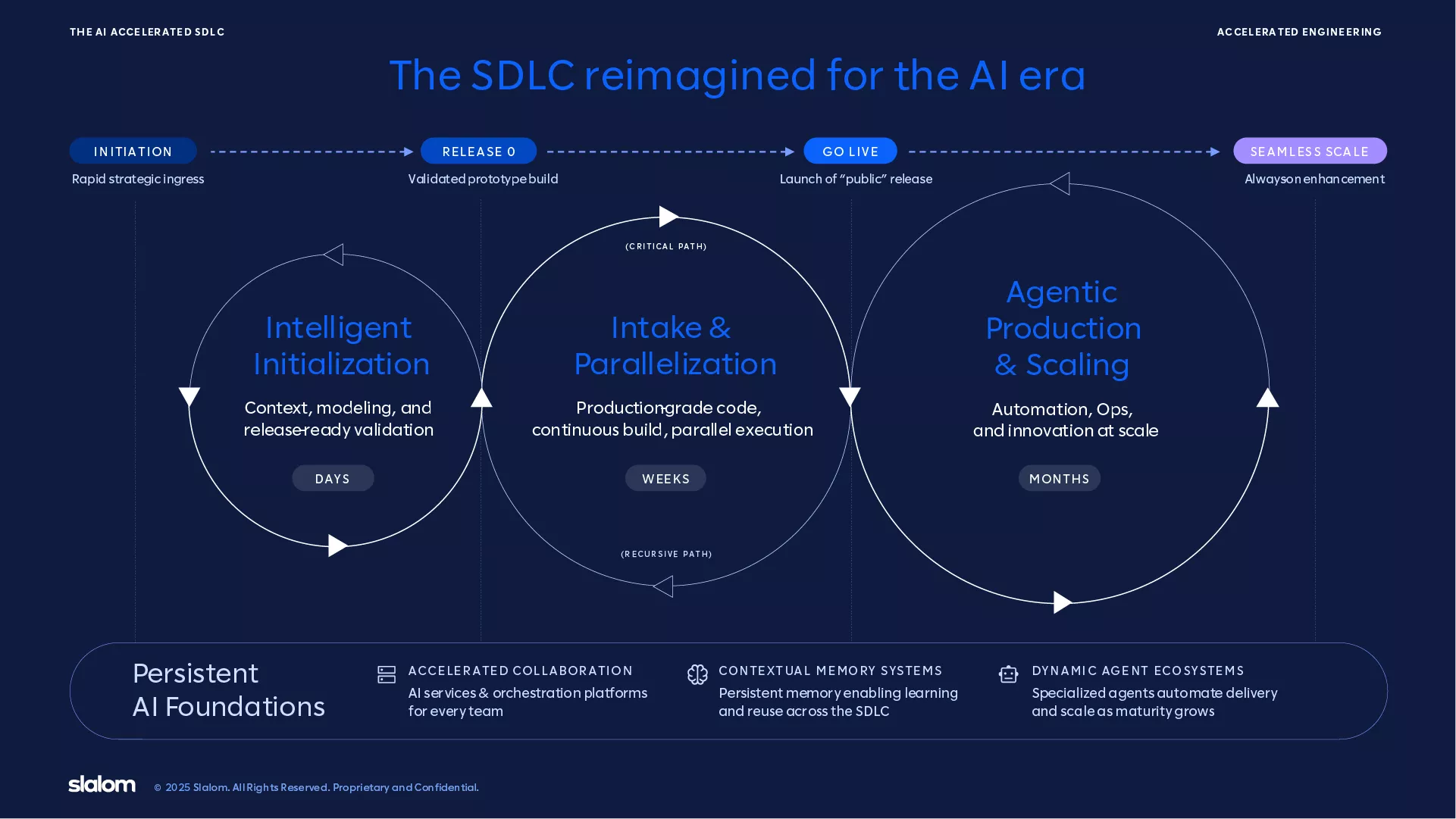

Rather than layering AI onto legacy workflows, accelerated engineering embeds it across the full software development lifecycle (SDLC), turning software delivery into a continuous, intelligence-driven loop. Human insight sets the direction. AI agents drive execution. Together, they create teams that learn faster, ship faster, and adapt in real time.

For institutions still relying on risk-averse, manually intensive delivery models, that shift is profound—and increasingly necessary. It means:

- Embedding AI tools across every phase of the SDLC

- Redesigning pipelines for closed-loop learning and observability

- Training teams to think like AI orchestrators, not just coders

In this model, humans steer vision, ethics, and design, while AI handles speed, scale, and synthesis.

Accelerated engineering isn’t just about building software faster. It’s a redefinition of how value is created across the SDLC. By embedding AI into the core of planning, building, and scaling, it turns fragmented workflows into coordinated loops. The result: more adaptive teams, higher-quality releases, and real-time alignment between business ambition and technical execution.

Rethinking productivity

Financial software productivity used to mean writing more code to support new account types, shipping more onboarding features, or building bespoke tools for evolving regulations. Today, it’s about delivering value with speed and precision. Success is no longer measured by output, but by adaptability—how quickly teams can respond to change, scale capabilities, and improve continuously.

Like compound interest, AI enables velocity that builds on itself. AI tools help developers create smarter systems that, in turn, improve the tools. Each improvement compounds the last. The result is a cycle of acceleration that reshapes what’s possible.

Consider an insurance provider deploying generative AI models. Rather than just accelerating claims processing, the organization begins to transform the entire customer experience. AI agents synthesize customer data (e.g., policy details, risk exposure, and engagement history) to recommend personalized coverage options and highlight potential gaps before a claim is ever filed. Instead of reacting to incidents, the system proactively engages customers at key life or seasonal moments, such as policy renewals, severe weather alerts, or changes in driving patterns. The result isn’t just faster claims—it’s smarter engagement, stronger retention, and better risk alignment across the customer lifecycle.

Compliance as Code

In regulated environments, compliance has long been seen as a bottleneck. With accelerated engineering, compliance becomes embedded and dynamic.

Imagine a capital markets firm where AI agents monitor trades in real time, cross-checking activity against evolving regulations like MiFID II or Dodd-Frank. When a new rule is introduced, the system flags impacted code paths and suggests compliant adjustments for human review. This closed-loop model reduces manual oversight, mitigates systemic risk, and keeps regulators continuously informed.

This shift turns compliance from a delivery constraint into a design advantage. With AI helping teams build compliance into every phase of development, regulatory adherence becomes faster, more precise, and far less manual than traditional approaches.

Revolutionizing cost-to-serve

As margins tighten and expectations rise, an AI native delivery model helps financial firms reduce service costs by embedding intelligence deeply into systems and workflows. Rather than coding each interaction, AI powered systems anticipate and meet customer needs.

For example, a major mortgage servicer used Slalom’s accelerated engineering approach to modernize outdated platforms, enhancing compliance, accelerating digital workflows, and establishing a scalable foundation for next-gen servicing. More than an IT upgrade, it was a foundational shift in how the organization builds and delivers software. The result: improved regulatory alignment, greater agility, and a faster, more intuitive customer experience.

These gains go beyond operational efficiency. By embedding intelligence across the stack, firms can deliver personalized, high-touch experiences to broader customer segments, serving the mass affluent with the same precision once reserved for ultra-high-net-worth clients, without increasing overhead.

Elevating developer experience

In this new human-AI paradigm, developers shift from builders to curators. They guide product strategy, ethical frameworks, and architectural decisions, while AI handles the implementation details: generating test plans, summarizing sprint artifacts, and tracking dependencies.

At a global payment services provider, teams piloting AI assistants like GitHub Copilot saw measurable improvements in code quality, developer satisfaction, and delivery speed—unlocking the blueprint to scale generative AI adoption with confidence. By offloading repetitive tasks, teams focused more on design quality, velocity, and innovation, making developer roles both more efficient and more fulfilling.

Headlines about AI replacing jobs reflect real concerns, but history tells a different story. With every wave of technology, roles evolve. Today is no different: AI isn’t replacing developers, it’s helping them become more strategic. By handling repetitive tasks, AI gives teams more space to do what humans do best: set business direction, navigate regulatory tradeoffs, and design financial experiences that build trust.

Toward agentic financial ecosystems

Agentic AI pushes financial platforms beyond static applications toward self-optimizing systems that learn, adapt, and act with minimal human intervention. Instead of software that simply processes transactions, imagine infrastructure that senses emerging risks, recommends responses, and even executes changes autonomously.

A payments firm, for example, might deploy autonomous agents trained to detect fraud signals using real-time sentiment analysis, regulatory news feeds, and cross-border transaction anomalies. These agents don’t just flag issues—they trigger countermeasures, adapt fraud models on the fly, and log activity for transparent auditability.

This shift signals a broader transformation: from software as a tool to software as an ecosystem—responsive, intelligent, and increasingly self-governing.

And it's not theoretical. Slalom clients are already embedding large language model (LLM) workflows into modernization programs, achieving up to 60% reductions in refactoring time for legacy codebases. When agentic infrastructure underpins these efforts, improvements compound, accelerating delivery, enhancing reliability, and enabling scale without sacrificing control.

The strategic shift

Adopting accelerated engineering requires a shift leadership mindset. Tactically deploying AI for chatbot support or fraud detection is no longer sufficient. The real opportunity lies in architecting your engineering organization for compounding, AI-native velocity. This includes:

- Embedding AI tools across all SDLC phases

- Redesigning pipelines for closed-loop learning and observability

- Training teams to think like AI orchestrators, not just coders

Instead of "How can we use AI to improve our current processes?" leaders should be asking: "How can we rebuild our engineering capabilities to take advantage of compound AI effects?"

Conclusion: Building at AI speed

We’re in an era where accelerated engineering is redefining how financial institutions build. By changing the "how," they’re unlocking new possibilities for what can be built—and how fast.

But this shift isn’t just about speed. It’s about enabling banks, insurers, and capital markets teams to move with precision in response to real-time expectations, shifting regulations, and rising complexity. When developers are free from manual overhead, they can focus on resilient architecture, risk-aware innovation, and experiences that adapt to customers in real time. In a market where milliseconds matter, accelerated engineering helps institutions not just keep up—but lead.